Here we bring you the examination of Investing in real estate vs Fixed Deposit.

The best way to make good returns on your investment capital is to invest for the long haul with a financial plan in place and by being disciplined. An investment can be a mix of low-risk, mid-risk and high-risk. Today we will discuss the investment in real estate vs fixed deposit and help you choose the best option among the two.

If you are looking for a secured investment in the long haul without taking the hassle of doing too much work Fixed deposit (FD) is the best option. In case you are looking to own an asset which will give you continuous cash flow and also offer price appreciation as time passes, investment in the real estate sector is the best option.

Fixed deposits are monetary investment options which offer a higher rate of return than a regular savings account. The money is locked in for a fixed time frame with a fixed rate of interest given on the sum.

The rate of interest on an FD in India generally ranges from 4 to 7 per cent in the public sector banks. The length of an FD fluctuates somewhere in the range of seven days to 10 years.

Some private banks offer interest rates of up to 8 per cent.

A regular flow of interest income may seem like a better investment, but there is a catch to it. The interest received on a Fixed deposit is taxable under the law.

Suppose the interest paid to the FD holder exceeds 10,000 rupees in a financial year, the bank levies a tax of 10% per cent on the interest earned. It is also called tax deducted at source(TDS).

The tax applied is according to the tax slab of the FD holder. Nevertheless, the fixed deposit may seem a stable source of investment as it provides a fixed return on the capital invested along with a fixed time horizon.

It all depends on the risk appetite and the individual financial goals of the investor. Let us have a look at the potential of investing in real estate.

The price of real estate was climbing high in the past few years, but due to Demonetisation, covid-19 and the current ongoing Russia-Ukraine conflict there has been a little slump in the price, which makes it the perfect time for investing in real estate to realise the highest possible appreciation in the long run.

Assuming you want to invest in real estate, there are a few key points-

1]

Location Matters.

2] Connectivity via public and private transportation.

3] Ongoing and upcoming infrastructural projects. (National Highway, metro,

airport and many more such projects that can have an impact on the price of the

property)

4] Is the project registered under RERA?

5] Evaluation of

price by following the market prices.

6] What is the proximity of

educational and Health facilities?

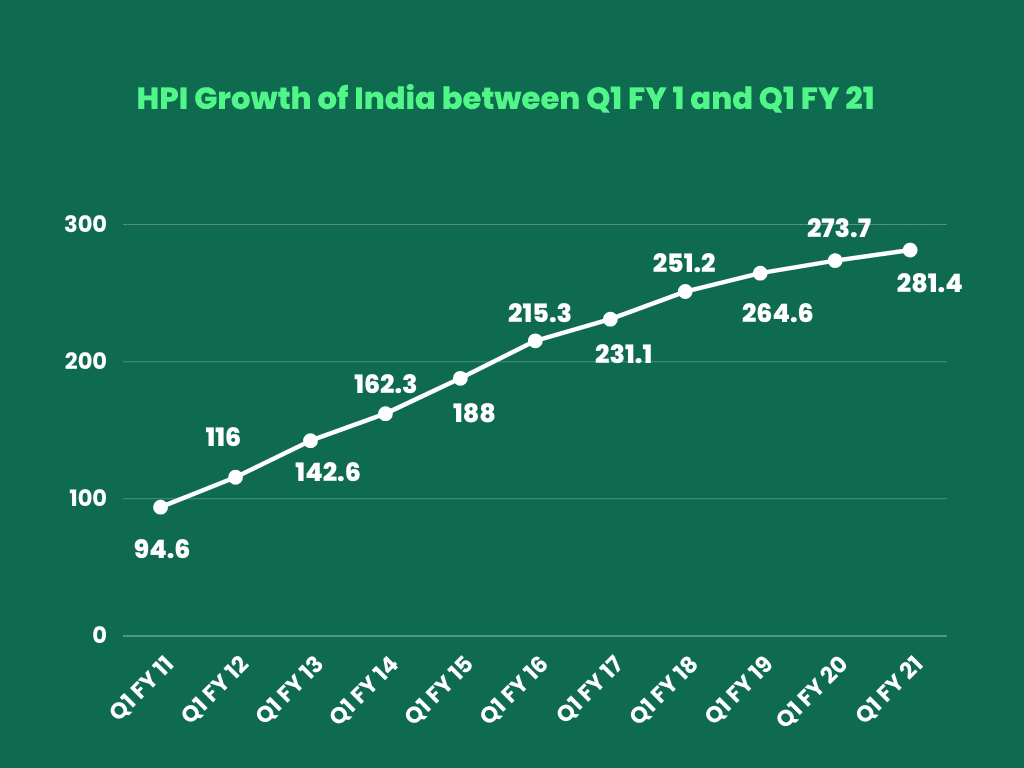

This data helps us gauge and show the lucrativeness of the Indian residential real estate market in the long run.

The Housing Price Index HPI is data published by RBI that shows the average home price rise in India.

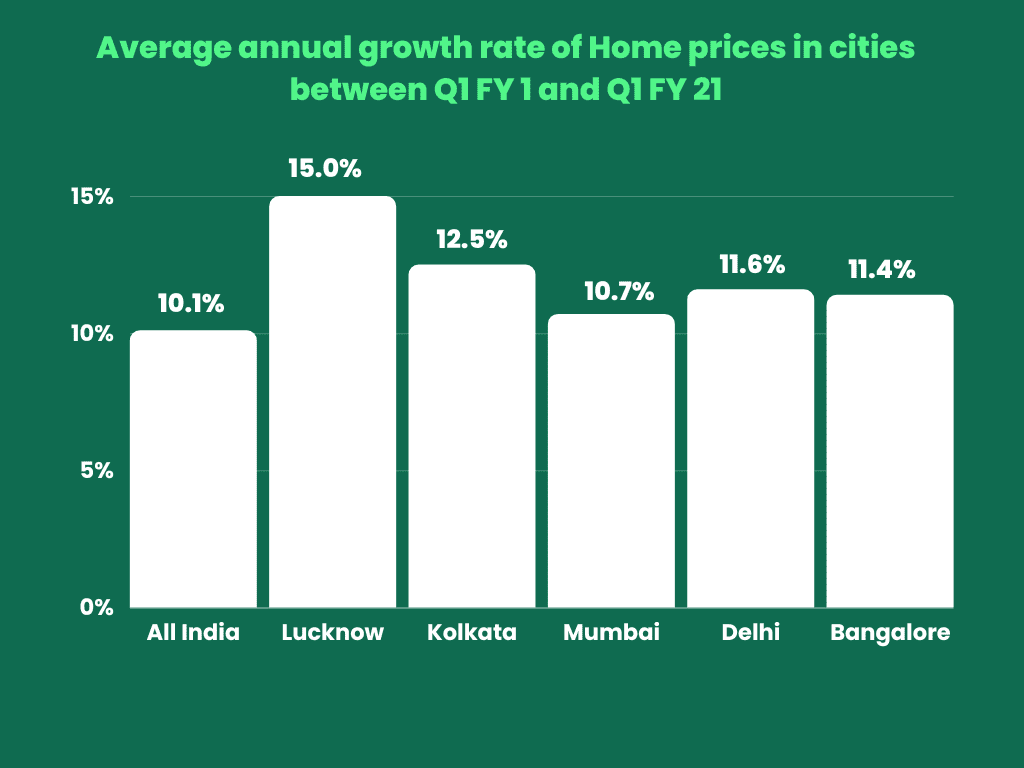

When we look at the multi-year data, we get to know that the average prices of homes in the country have grown by 10%. The growth varies for Tier 1, Tier 2 cities and so on.

A Decade of Returns from the Residential Real Estate.

Looking at the Q1 all India HPI data from the graph we can calculate the average annual rate at which the prices of the property have risen stands at 10.1%

Source: RBI's House Price Index

But if we analyse the returns across different cities, it varies. The bar chart below showcases the city-wise and all-India average annual growth rate in Home prices.

Source: RBI's House Price Index

In a nutshell, investing in real estate is among one vehicle that you should position your capital looking at India's long-term growth potential, as one will benefit from a regular stream of rental income and asset price appreciation in the long run.